China Macro

Where are we in the financial sector deleveraging process?

Regulatory clampdowns will add short-term liquidity pressure in the market

In the past 10 years, with the ongoing financial disintermediation and financial market innovation, the leverage in the financial system has significantly increased. The asset management industry also rises to become the conduit for banks to invest into bond/equity market and non-standard credit assets. Since end of 2016, the regulators started to roll out a series of regulations aiming at reducing systemic financial risks. We believe this deleveraging process will last throughout 2018 until interbank liability, conduit type of asset management business and non-standard credit have significantly come down. We view this positive for the sustainable growth of China’s financial market and it will help improve the capital allocation efficiency. However, short-term pain is unavoidable. We expect to see more mini liquidity crunches in certain parts of the financial system for the rest of the year.

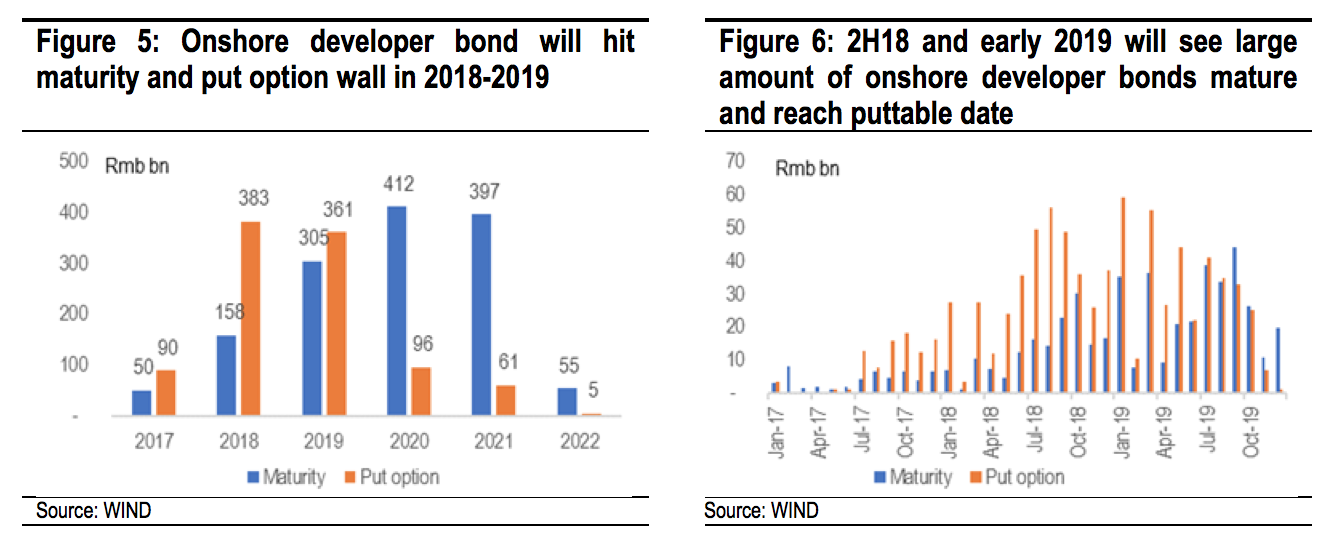

Interbank liability and asset management industry ballooned in 2012-2016

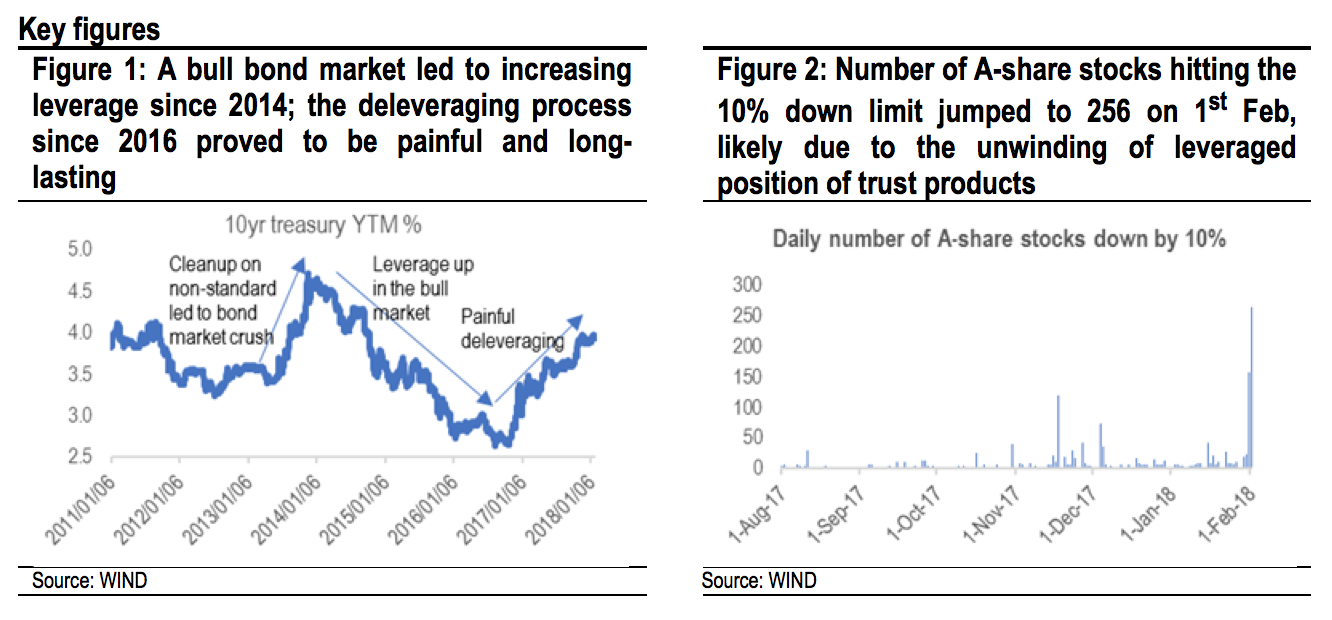

As of end-2017, we estimate financial institutions’ interbank liability reached Rmb 90trn, and the big asset management industry AUM reached Rmb 100trn backed by funding from banks. This is meaningful compared to total banking system assets of Rmb 250trn. Systemic risks have been built up with increasing bank assets being leveraged up with duration mismatch and investing into the bond/equity market and flowing into the real estate market and LGFVs. The onshore bond market was pushed to an unsustainable level with 10yr treasury touching 2.5% in 2016. With the ongoing cleanup in interbank liabilities, non-standard credit and asset management industry, 10yr treasury is now standing at 3.9%.

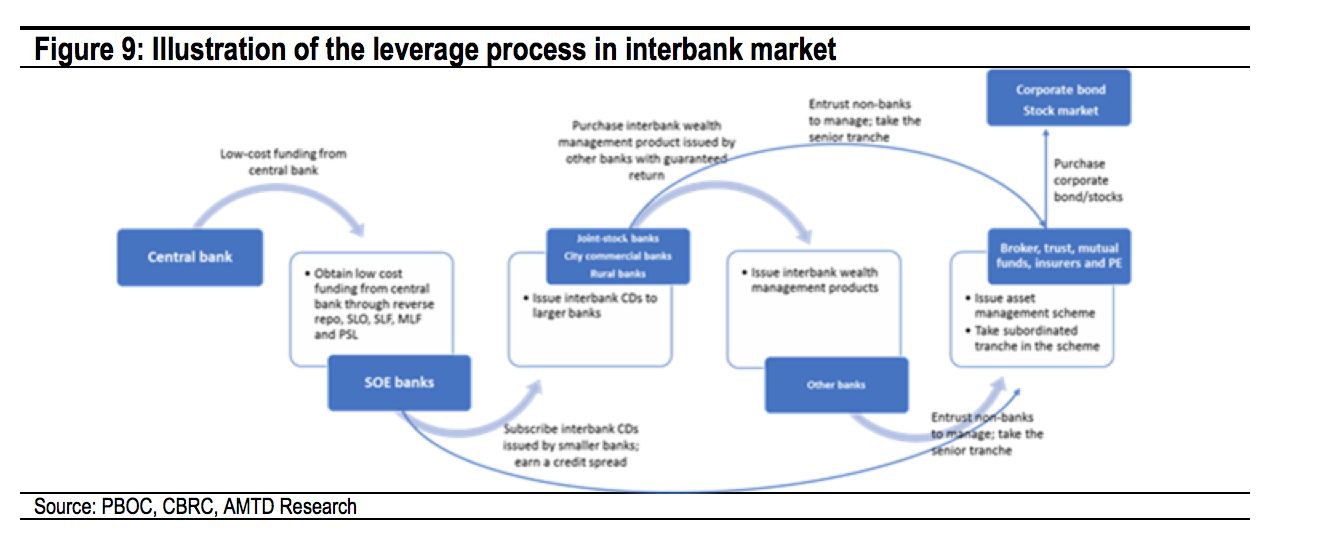

Watch out for the onshore developer bond maturity wall in 2H18 and early 2019

Developers and LGFVs are the two largest groups of borrowers in the non-standard credit market. They are likely to feel the challenge to refinance during the cleanup of non-standard credit. According to WIND data, there are Rmb 158bn of developer bonds that mature in 2018 and Rmb 305bn in 2019. In addition, a historical high of Rmb 383bn of developer bonds will reach puttable date in 2018 and Rmb 361bn in 2019. We remind investors to watch out for high maturity months in 2H18 and early 2019. Developers will have higher incentive to borrow at higher cost in offshore market.

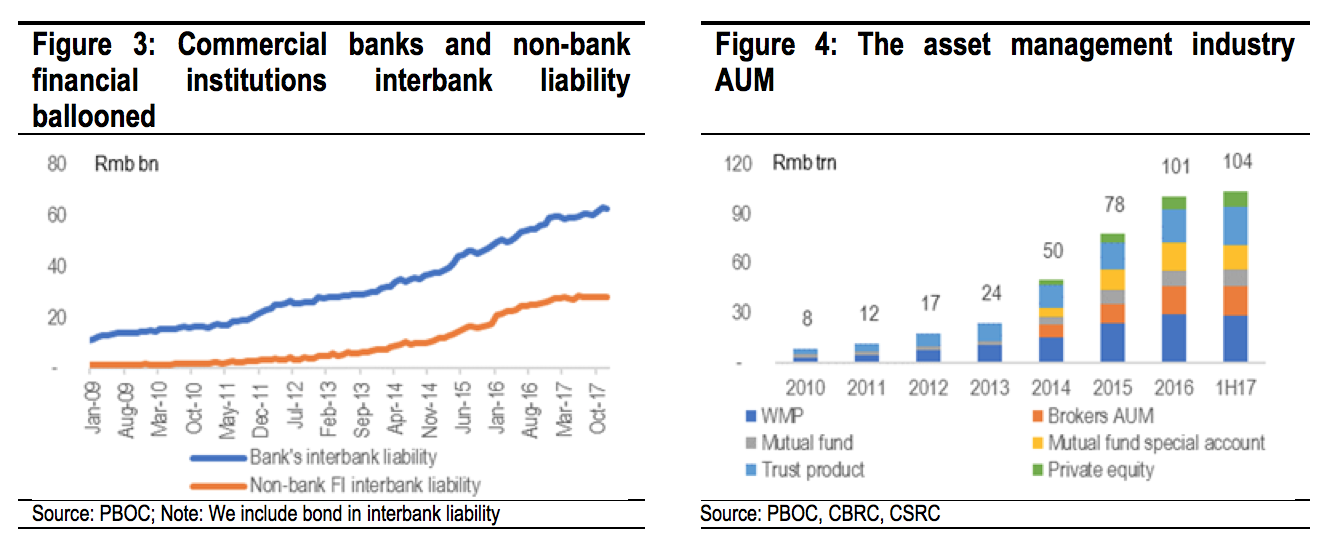

Unwinding leverage in the stock market

On 1st February 2018, there were 265 stocks that hit the daily 10% down limit in the A-share market. What these companies have in common is that they have trust asset management schemes among their top 10 public shareholders. We believe Vanke’s Independent Director’s public letter to CSRC triggered a panic unwinding of the asset management scheme under trust companies. The letter highlights one of its major shareholder Baoneng has violated the leverage cap requirement for asset management business. The trust company’s schemes still have 2-3x leverage backed by funds entrusted by banks. We advise investors to avoid companies with trust schemes among top public shareholders in the near term as the unwinding process will take time. There is low visibility on the trust schemes’ holding in Hong Kong stocks through stock connect. Investors should be alerted to such risks.

Economic growth to slow down on slower credit growth

We expect the broad credit growth as measured by total social financing growth to significantly slow down from current run rate of 12%. However, bank loan growth is likely to remain stable to partly offset the likely drop in non-standard credit. Developers and LGFVs may experience rising financing cost and shortage of new credit which may drag down property investment and infrastructure investment from a high base in 2017.

|

|

|

|