AMTD Research: China Online Consumer Finance Industry Report – Regulatory Scrutiny vs Market Potential

In this report, we try to analyze the China consumer finance industry’s competitive landscape, explain how the payday loan lenders are different from P2P platforms in their business model and profit model, by looking at industry data as well as listed companies’ financial data. Despite tightening regulations, we still believe online consumer lenders have big market potential through analysis of penetration rate and household debt level.

Consumer finance penetration fast rising

The online consumer lending industry in China has played an indispensable role in providing consumer finance to the underbanked population. We estimate that as of Sep-17, the total consumer loans outstanding has reached Rmb 10.1trn, +38% compared to Dec-16. In 9M17, the consumer finance penetration rate reached 30.7%, up from 14.7% in 2015, driven by the fast expansion of credit card installment loans provided by banks and proliferation of online lenders.

Regulatory scrutiny add big uncertainty to payday loan lenders

However, recently the fast-rising untamed payday loan lenders have caught regulators’ attention. We see near term challenges for the payday loan lenders and P2P platforms that focusing on payday loan product. For the general P2P industry, growth may continue to slow down in the near term as the regulators are still focusing on cleaning up the incompliant businesses. This may give commercial banks and licensed consumer finance companies opportunities to take up market shares in the short run.

Leading P2P platforms to resume growth once P2P registration is completed by April 2018

In the long run, we believe the leading P2P players are in good shape to resume growth once the P2P registration is completed by April 2018. We expect industry consolidation and increasing concentration after the cleanup. We still see big growth potential for the under-penetrated consumer finance industry driven by 1) strong consumption growth; 2) increasing consumer financing penetration.

Stock market sentiment slowly recovering

Stock market sentiment is slowly recovering on this sector as the payday loan lenders/platforms (Rong 360, Paipaidai) started to report encouraging 3Q17 earnings. We may need to wait for another one or two quarters earnings to see how the new regulations would reshape the industry.

Online consumer finance doesn’t change the essentials of finance

We think online consumer finance industry does not change the nature of lending business, no matter it is a pure platform or balance sheet lender. A winning player ideally would have all of the following characteristics: 1)effective risk management and risk pricing capability; 2)cheap and stable funding; 3)self-owned retail ecosystem; 4)strong branding with user loyalty and repeating users; 5)effective cost management. Naturally this would point to lenders affiliated to e-commerce platforms or retailers. However, there will be room for specialized lenders focusing on a vertical segment such as auto, travel, education, entertainment, cosmetics and apparel.

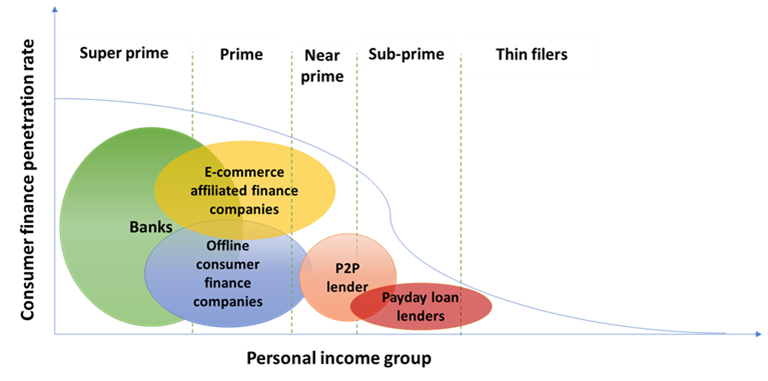

Figure 1: Consumer finance market segmentation

Source: AMTD Research